Bob Hoye and Ross Clark have been in the investment business for some 50 years, making them one of the more experienced researchers. Their historical work has been thorough, providing the first recognition of the fascinating transition from speculation in commodities to speculation in financial assets. It was controversial when Bob observed that “No matter how much the Fed prints, stocks will outperform commodities”. In January 2000, the research team concluded that the Dot-Com Bubble would peak in March 2000. In early 2007, the team outlined that the credit markets would reverse in May-June 2007. They did and the stock market followed.

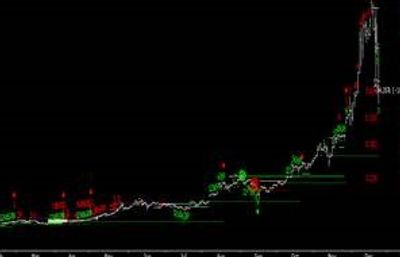

The call in early October 2017 was for the Bitcoin Bubble to complete in December. Bob’s essays and speeches on political change and on actual climate change have been widely circulated. Our research is based upon a thorough review of financial history. That every great financial bubble has had similar beginnings and endings has been our contribution to the economic literature. This, when combined with our proprietary technical analysis, has enabled some practical calls.

For example, on October 4, 2017 it was that “Everything could be bubbled, including the DJIA”. In reviewing that a number of outstanding speculations completed near the turn of the year, our target was the December-January window.

At significant tops, the question becomes “Is it up when it should be?” and the ChartWorks confirms the likelihood of a reversal with two possible determinations. One relates to momentum and the critical condition is Upside Exhaustion. Based upon pattern, is the Sequential Sell. On the Bitcoin blow-off, the latter registered on December 19, which was the high day. A technical signal within the window of opportunity.

At significant lows, the question is “Is it down when it should be?”. And the “buy” is based upon Downside Capitulations, which helps to avoid “falling knives” going into a cyclical bottom. Confirmation with a Sequential Buy adds to the confidence on the decision. The ChartWorks had a Springboard Buy on November 3, 2016, just before the US election. This signal is designed to identify opportunities in a flat to rising trends, which takes much of the guesswork out of “Buying the dips”.

Our essay American Spring, published on July Fourth, 2016 and updated on September 28, reviewed that the popular uprising would likely win the election. For the past decade, our quip has been that in financial and political markets it is the most fascinating time in history to be vertical as well as aware.

In an integrated fashion, our methods have been practical in credit spreads, the yield curve, industrial commodities, currencies, precious metals and equity markets. Our regular weekly report is written for the portfolio manager and the ChartWorks, which publishes on opportunity, supplements the skills at trading desks.

Interest Rate Markets

We are one of the few research teams that “got” both ends of the great bull market for Treasuries. In 1981, it was that inflation was over and “No matter how much the Fed tries to print, financial assets will outperform commodities”. The transition from inflation in tangible assets to inflation in financial markets has always been fascinating. As will be the eventual transition from inflation in financial assets to deflation in most assets – no matter what the Fed tries to do.

In June 2016, the ChartWorks noted the technical excesses in the bond future, identifying a major top. We noted that while the Euro bond market was difficult to analyze in the same way, conclusions made in the US market could be applied to Europe. Long dated Treasury and Euro-sovereign yields have been rising since.

Junk bonds were likely to continue rallying, which may have reached their best in January. In a post-bubble contraction junk bond prices collapse. It has to do with difficulties in servicing debt and disappearing liquidity, not the return of Consumer Price inflation.

Bubble Completions

March 2000:

Our “Boom Indicators” turned negative in December 1999. In January, we began noting that bubbles can run some 12 to 18 months against an inverted curve. We chose March (the 14th month) as the likely month for the reversal. It took from March through April to reverse. The Nasdaq and S&P peaked in that fateful March, when stocks and credit markets essentially reversed at the same time.

Central banks have little influence on the curve or spreads when credit markets become over-extended and reverse. In so many words, the power shifts from the Fed to margin clerks. One of the Fed’s duties has been that, as a lender of last resort, it would prevent the financial setbacks that precede recessions. There have been 18 recessions since the Fed opened its doors in January 1914.

Downside Capitulations registered in September 2002.

October 2007:

On that bubble, the potential change in the credit markets counted out to around May. By early June there was enough of a change to force the problems at Bear Stearns. In that month, our PP included that for the credit markets it was the start of the “Greatest Train Wreck in History”.

The key to that stock market peak was the Second Breakout on curve-steepening, which occurred in August. Steepening usually helps banks, but in a completing bubble it signals contraction. The S&P topped in October. Beginning that August, we often noted that the sharpest declines in short-rates occur in severe bear markets. The Street was touting that a “Fed cut” would keep the party going. History records that rising short rates confirm that the boom is on. Declining rates indicate the boom is rolling over.

Downside Capitulations were recorded in October 2008 and in March 2009.

Latest Bubble:

The action was likely to climax near year-end. The Bitcoin high was in December and the S&P set its high in January.

On the stock market rebound, credit markets and industrial commodities would help in providing “sunshine” into May-June. The “sunshine” has been brighter than the stock market. The rising trend in the T-Bill rate is still on.

The target time for the next set of Downside Capitulations and Sequential Buys will be determined at a later date.

Copyright © 2026 ChartsandMarkets.com - All Rights Reserved.https://img1.wsimg.com/isteam/ip/237d4c04-2f33-46a2-ae8f-fa026c40b5d8/LIT%20241011.jpg/:/rs=w:70,h:70,cg:true,m/cr=w:70,h:70,a:cc